In this section, we’ll look at Alpha Lumber’s (fictional) financial data to calculate its accounts receivable turnover ratio. Then, we’ll discuss what the company’s ratio says about its current status and identify areas for improvement. Any businesses that are affected by seasonal operations, such as landscapers, may have mixed accounts receivable turnover ratios that are not a reliable indicator of business efficiency.

Determine net credit sales

However, it’s important to consider industry norms when evaluating this ratio, as asset utilization varies significantly across sectors. Depending on the industry, a high or low ratio may mean different things. Now that we have understood its importance, here are a few tips for businesses to tap in order to increase the receivable turnover ratio. The liquidity ratio is used to measure a company’s ability to pay its short-term obligations. The most common liquidity ratios are the current ratio and the quick ratio. While the receivables turnover ratio can be handy, it has its limitations like any other measurement.

See Today’s BestBanking Offers

If clients have mentioned struggling with or disliking your payment system, it may be time to add another payment option. Of course, you’ll want to keep in mind that “high” and “low” are determined by industry norms. For example, giving clients 90 days to pay an invoice isn’t abnormal in construction but may be considered high in other industries. Businesses that complete most of their purchases by extending credit to customers tend to use accrual accounting, as it accounts for earned income that has not yet been paid. Cash basis accounting, on the other hand, simply tracks money when it’s actually paid or spent on expenses. A high Working Capital Turnover ratio means that the working capital is being very efficiently utilized.

Comparing Different Financial Planners

- Lastly, many business owners use only the first and last month of the year to determine their receivables turnover ratio.

- It also helps them analyze how efficiently the stock and its reordering is being managed by the purchasing department.

- As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

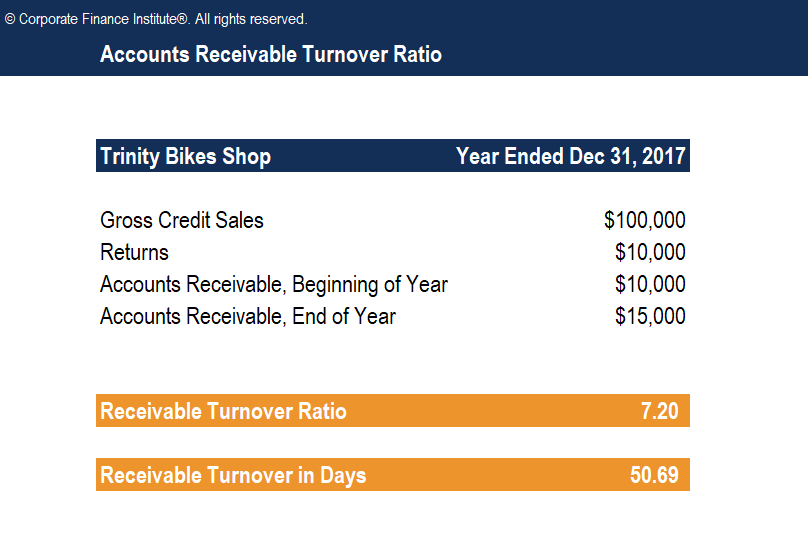

Average accounts receivable is used to calculate the average amount of your outstanding invoices paid over a specific period of time. These ratios basically measure the efficiency with which assets are being utilized or managed. This is why they are also known as productivity ratio, efficiency ratio or more famously as turnover ratios. Receivables turnover ratio is a measure of how effective the company is at providing credit to its customers and how efficiently it gets paid back on a given day.

Receivable Turnover Ratio FAQs

This metric is commonly used to compare companies within the same industry to gauge whether they are on par with their competitors. To identify your average collection period, divide the number of days in your accounting cycle by the receivables turnover ratio. It calculates the velocity with which creditors are paid off during the year. It helps the management judge how efficiently the accounts payables are being handled. The accounts receivable turnover ratio can be used as a measure of efficiency when comparing businesses from the same or similar industries.

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. It will indicate the ratio between how much a company has invested in one particular type of group of assets my home is in foreclosure and i have a $100,000 gain and the revenue such asset is producing for the company. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

While we study the accounts and financial statements of an entity, we can gauge its current financial position. But can you tell the efficiency of the firm by just looking at the accounting statements? No, and this is why the management calculates and studies activity ratios. Let’s see some simple to advanced practical examples of turnover ratio formula accounting to understand it better. Let us understand the different turnover ratio calculation formula and how to calculate them in details.

She has specialized in financial advice for small business owners for almost a decade. Meredith is frequently sought out for her expertise in small business lending and financial management. Picking the right fiscal year for your business can save you and your accountant a lot of time, money and stress.

Comentarios recientes