Google’s most recent project in this sector is an augmented reality concept called WebXR. To encourage interest and development in the VR market technology, Google introduced this product. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors.

- Samsung has also entered the NFT marketplace by adding an NFT platform into their smart TVs and devices.

- Experts project that the sector will expand at a compound annual growth rate (CAGR) of 15% from 2022 to 2030.

- Immersion is an excellent pure play for investors seeking virtual reality stocks that are only engaged in the development of VR technology.

As well, the company features an ROE of 26.6%, suggesting a high-quality business. Matterport is more speculative because it’s so new to the public markets and not yet profitable. So, only those comfortable with these traits should consider investing in it now.

The 7 Best Virtual Reality Stocks to Buy Now

Upcoming products include a Vive Pro 2 for 5K gaming and Vive Focus 3, which is a professional business VR headset. Unity has a massive market share and accounts for over 71% of the top 1000 mobile games currently on the market. Some other things to consider when looking for Virtual Reality firms to invest in. Many of the industry-leading VR companies are privately held and not available for public stock sales.

One of the earliest applications is called Sodar, and it allows you to see a 6-foot social distance in any scenario. After a brief decline caused by Covid-19, Google’s stock is doing capital gearing ratio is also known as better than ever. This is readily accomplished by dividing the dividend by the stock price. Typically, you may purchase AR stocks via the business, stockbrokers, or agents.

Some analysts think this stock could push even higher, as their revenue numbers have looked very strong. Nvidia has worked to ensure their technologies are in line with the performance capabilities of the most popular tech companies. Nvidia prides themself on their ability to easily integrate their solutions with the user experience.

Since they have deep pockets, they can target the capital and resources to enhance their footprint in the virtual reality segment. Instead, some companies specialize in various virtual reality components and serve a broader base of applications and customers. Virtual reality is often an add-on service for many technology companies. As you become more interested in virtual reality investment, you must have a game plan. First and foremost, it pays to know about investing in technology stocks. Finding virtual reality companies to invest in will take some legwork, but preparation is vital.

Facebook changed its corporate name to Meta Platforms

META

to focus on these new forms of communities. So has Microsoft, with both of the companies working on AR and VR hardware. Pepsi tried out an ad in London using AR in 2014 through a prank bus stop that showed people waiting inside outrageous visual stunts that weren’t actually happening in the real world. At the end of the fourth quarter of 2020, 39 hedge funds in the database of Insider Monkey held stakes worth $545 million in the firm, down from 40 in the previous quarter worth $501 million.

Virtual Reality Stocks Headlines

And that’s just one reason why investors should keep NVDA stock in mind moving forward. In addition, let’s not forget the Omniverse, the company’s metaverse project, which allows its engineers to collaborate and share their ideas. Nvidia is a company that specializes in making graphics cards, processors and other computing devices. They have been around since 1993 and have grown exponentially over the years. Now, though, Nvidia chief executive officer (CEO) Jensen Huang has stated that AI-powered computing devices will drive the future of AI. Microsoft has been investing a lot in artificial intelligence (AI) research.

Grandview Research shows the industry should grow to $87 billion by 2030. If virtual reality has piqued your mind, then you are probably wondering how to invest in virtual reality companies and profit from the technology. https://1investing.in/ Rather than investing in a company that solely does virtual reality, it’s more prudent to consider companies that cover multiple aspects of virtual reality besides complementary services and products.

Sony Corporation (NYSE:SNE)

Financially, the company’s ad network represents a cash flow opportunity as advertisers flood new VR spaces. Those ad opportunities became apparent as Unity reported a 16% earnings surprise and a net profit despite marking a massive loss the previous year. Hedge fund White Brook Capital summed up Unity’s unique position in virtual reality markets succinctly, but the core tenets bear repeating. Unity is positioned to take advantage of VR and augmented reality (AR) emerging as greater players in tomorrow’s entertainment spaces. Much of the virtual reality-centered bust came from a “too soon, too fast” mentality.

Microsoft expects to earn between $49.2 billion and $50.2 billion in the fiscal first quarter. All are involved in AR/VR but none of them depend on it for their entire existence. But the results are far from clear, which puts a premium on the right companies. To be fair, in 1980, no one could have known about the rapid advances in communications hardware, in the amount of computing power that could fit in your hand, in software. Even Steve Jobs, in 2007, didn’t think that apps would be important on phones, as the Walter Isaacson authorized biography of Apple’s most famous CEO recounted.

However, analysts expect Meta to launch another VR headset in the second quarter of 2022 that could give users a more immersive experience. Revenues for the first quarter reached an impressive $320.1 million, increasing 36% year over year. That shows people are willing to adopt its technology to create smarter, more personalized content for an engaged audience. Its loss from operations came in at $171.2 million, or 53% of revenue, compared to the figure for last year when it stood at 47%. This translates to a compounded annual growth rate (CAGR) of 31.8%, compared to a CAGR of only 5.3% for the overall gaming console market over the same forecast period. After this market hits the ground running, investors will be glad to own the three VR/AR stocks discussed above.

Advanced Micro Devices, Inc. (NASDAQ:AMD)

Its platform enables the creation of detailed 3D digital replicas — or «digital twins» — of buildings and other physical spaces. What’s more, Meta has partnered with Ray-Ban parent EssilorLuxottica to offer smart glasses. The two companies launched the Ray-Ban Stories series of smart glasses in September 2021 at a starting price of $299. This could unlock another opportunity for Meta as Mordor Intelligence expects the smart-glass market to generate almost $8 billion in revenue by 2026 compared to $3.9 billion in 2020.

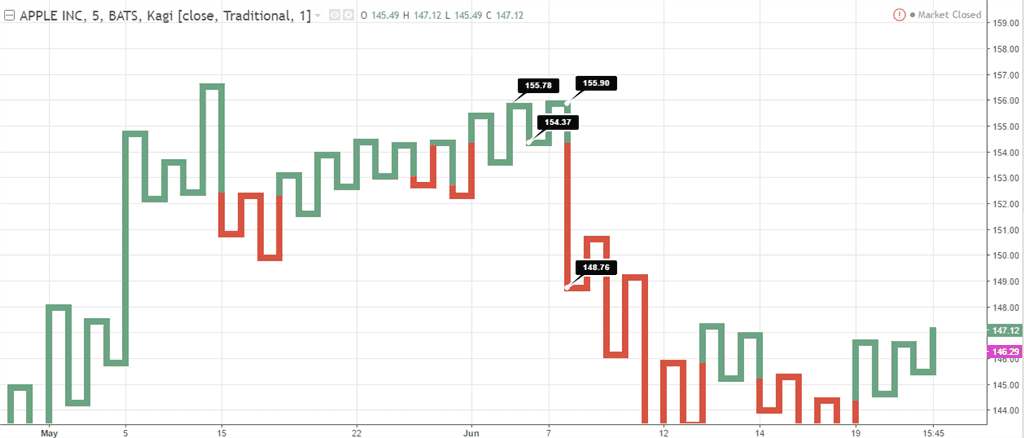

Adjusted for one-time items, net income soared 99% to $4.9 billion, or $1.95 per share. For investors, there’s a lot to like about a fast-growing company churning out a fat adjusted profit margin of 40%. Apple is a consumer electronics giant that sells popular products ranging from iPhones to iPads and MacBooks. So, it is not surprising to see reports of the tech titan entering the AR/VR headset market. All this indicates that Meta could turn out to be a top VR stock in the long run. Its annual earnings could grow faster than Wall Street’s projection of 21% for the next five years as the VR market continues to expand.

Virtual reality presents an early opportunity for investors to get in on the ground floor of potentially transformational technology. The VR market is highly competitive, and companies must invest significantly to stay ahead of the curve. Moreover, it is still unclear how consumers will ultimately use virtual reality. However, investing in VR can lead to increased returns for those with higher risk tolerance. Virtual reality (VR) is one of the trendiest technologies currently attracting the attention of investors.

The digital transformation of business and personal day-to-day lives, combined with the migration to the cloud, will continue to draw people, especially younger ones, to the metaverse. However, technological advances and the entrance of new companies into the market have renewed interest in VR. Data from Fortune Business Insights shows the virtual reality market is projected to expand at a compound annual growth rate of 45% through 2029, hitting $227 billion. As a result, the industry makes for an exciting and potentially lucrative investment opportunity.

Microsoft, a one-stop shop for consumer technology and a major rival to Sony in the video game industry, presents a convincing case for VR integration. However, the corporation has not developed any alternatives, which reportedly makes Xbox console enthusiasts anxious. However, it doesn’t appear to be as much a priority as gaming and entertainment. For example, while Cedars-Sinai can technically make its software available in the Meta Quest Store, users would have to go to a section of the store called the App Lab to access it.

Hololens is their premium AR headset that has been extremely successful in commercial, educational, and military sectors. The headset is ideal for these sectors and allows users to interact and work with others from around the world. Patents that were filed in July 2020 showcase technologies that display 3D images and holograms on walls and physical objects.

Motley Fool Investing Philosophy

Investors can take advantage of this fast-growing market through Meta Platforms (META 1.03%) and Apple (AAPL -0.99%). While Meta is already taking advantage of the VR opportunity, Apple is rumored to be joining the fray in 2022. Let’s see why investors looking to buy VR stocks shouldn’t overlook these tech giants. In its latest results, Apple’s revenue grew 2% compared to a 36% growth versus last year and 8% sequentially.

4 Stocks Set to Profit From the New China Apple iPhone Ban – InvestorPlace

4 Stocks Set to Profit From the New China Apple iPhone Ban.

Posted: Tue, 12 Sep 2023 18:45:53 GMT [source]

The Motley Fool has positions in and recommends Apple, Meta Platforms, and Nvidia. Buying Apple stock for its VR prospects will be a long-term investment. However, it could also be an early investment in the future leader of the industry.

This could be a massive selling point for companies building VR headsets. Having said that, Meta has had success in its VR efforts, evidenced by strong sales from its Quest device and software sales. It has reportedly sold over 15 million Quest 2 headsets since its release in 2020. Moreover, Meta announced at the Connect conference late last year that $1.5 billion in content sales from its Meta’s Quest store were recorded since its launch in 2019.

For those looking for virtual reality stocks that are solely involved in the development of VR technologies, Immersion is a great place to start as a pure play. In turn, investors have become fond of VR stocks because this industry seems to be a success. They hope that the virtual reality industry will provide them with a lot of value in the future.

Comentarios recientes